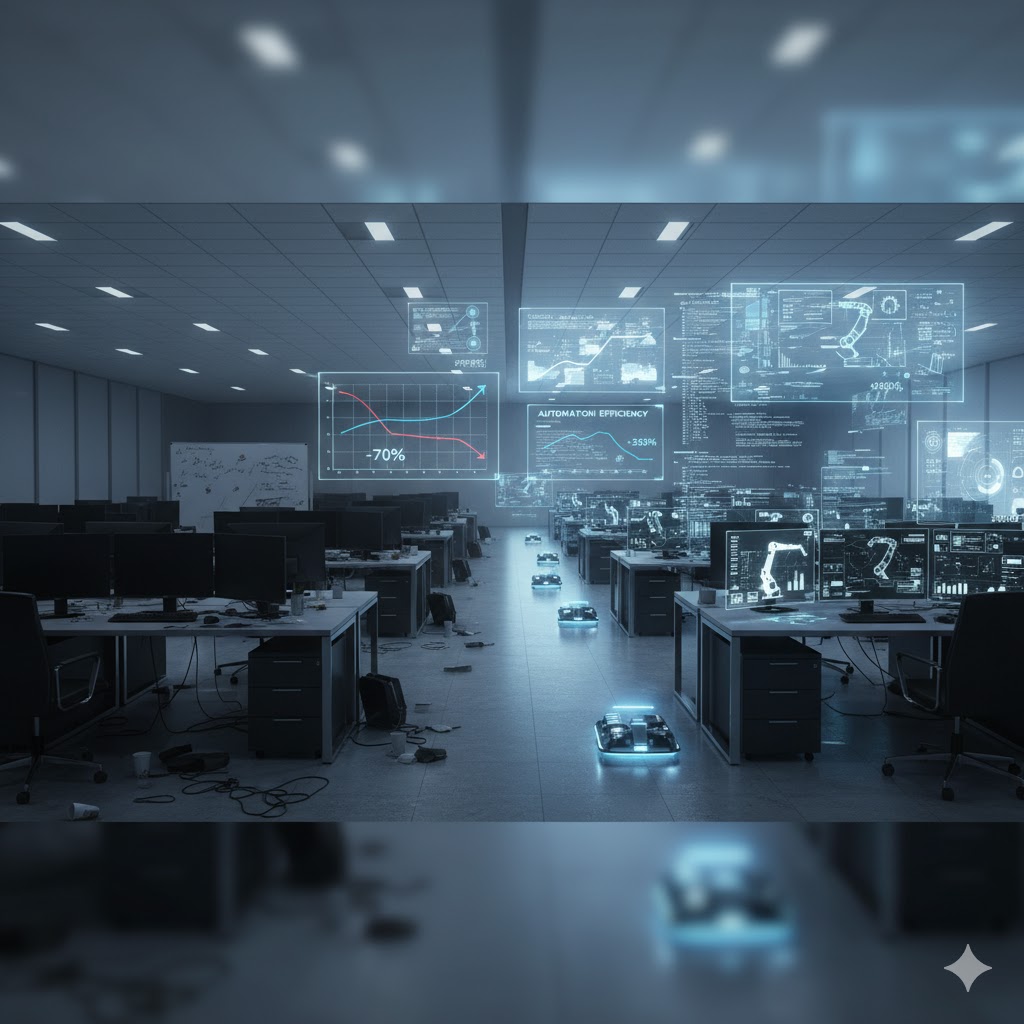

The private equity and big tech playbooks are converging on a singular strategy: replace expensive human workers with automation.

This week, Vista Equity Partners and Meta sent unmistakable market signals that the AI-cost-cutting wave is shifting into higher gear.

Vista told investors it will slash headcount by up to one-third, automating investor presentations, data aggregation, and deal analysis with AI.

Meta, meanwhile, cut 600 roles across its AI research and infrastructure teams, signaling that even elite technology companies see duplicative roles and junior positions as expendable.

These moves from two corporate titans suggest a broader restructuring across finance and tech is underway, one that’s already claiming more than 30,000 jobs this year tied directly to AI adoption.

The PE playbook: Margin extraction at scale

Vista’s announcement carries particular weight because private equity firms have perfected the art of operational leverage.

The $100 billion software-focused shop told investors to expect workforce reductions through both layoffs and deliberate hiring freezes.

CEO Robert F. Smith explicitly signaled that automation will replace functions previously handled by dozens of analysts, operators, and support staff.

Think investor decks, marketing collateral, and data assembly for deal screening tasks that consume junior staffers and mid-level professionals.

When you multiply that across Vista’s sprawling software portfolio, the aggregate cost savings become staggering.

This isn’t theoretical. Vista controls stakes in hundreds of software companies, meaning its operational directives cascade downstream to portfolio companies as well.

When the parent company signals a margin-expansion priority around AI, subsidiaries follow suit.

The mechanism is elegant and scalable: transactional work, spreadsheet building, basic analysis, and routine client communications get automated first. Junior analyst and associate roles feel the brunt.

Mid-market PE shops and software companies, watching Vista’s playbook, are already taking notes and mirroring the moves.

The financial incentive is straightforward. Vista’s operating model thrives on extracting margin improvement from portfolio companies.

AI automation of repetitive tasks generates outsized cost savings when applied across dozens or hundreds of portfolio firms.

That translates into higher multiples at exit, richer returns for LP investors, and increased fees for the fund. For an executive compensation framework tied to cost reduction, the incentive is crystal clear.

Meta’s consolidation: The efficiency reckoning arrives

Meta’s October restructuring, while smaller in headcount terms, matters because it reveals how even the most AI-capable tech firms see redundancy in their own AI operations.

The company cut roughly 600 employees across its Fundamental AI Research (FAIR) team, AI infrastructure units, and product-related roles.

Chief AI Officer Alexandr Wang’s memo was blunt: the team had become “bloated,” with overlapping responsibilities between FAIR and product groups creating bottlenecks.

By cutting headcount and keeping it lean, Wang promised “fewer conversations” to make decisions and “more scope and impact” per remaining employee.

What’s telling is what Meta didn’t cut: the newly formed Superintelligence Labs, staffed with recently hired top-tier researchers.

Meta is essentially consolidating its AI work, eliminating what it deems less-critical roles while doubling down on cutting-edge research and product development.

The Superintelligence Labs now sits at just under 3,000 employees, a focused, efficient unit compared to the sprawling FAIR structure.

For junior analysts, mid-level researchers in non-core teams, and operational support roles, the message was clear: your role no longer fits the next-generation AI org chart.

The broader trend: No longer an outlier

Vista and Meta aren’t outliers; they’re bellwethers. Across finance and technology, more than 141,000 tech workers have been cut in 2025 alone, with over 31,000 of those losses explicitly tied to AI adoption and automation.

Accenture eliminated 11,000 positions in October, citing roles that couldn’t be reskilled for the AI era. Salesforce slashed its support team in half, citing AI’s ability to handle 50% of customer conversations.

Amazon cut 14,000 corporate roles, citing “AI-driven processes” and management layer streamlining.

The through-line connecting these moves is stark: entry-level and middle-tier roles in analytics, operations, basic research, and support functions are vanishing fastest.

These aren’t just cyclical downturns; they are structural shifts in how companies expect to operate.

As AI tools mature and become embedded in operational workflows, the competitive pressure to adopt them spreads from hyperscalers to mid-market firms to private equity shops.

For investors and workers, the November signals from Vista and Meta are less surprising announcements than inevitable milestones in a technology-driven reshuffling that’s only accelerating.

The post The next wave of AI-driven cost cuts: Vista and Meta send clear signals this week appeared first on Invezz