Firefly Aerospace shares fell sharply after one of the company’s rockets exploded during testing, raising new concerns about the challenges facing the newly public space technology provider.

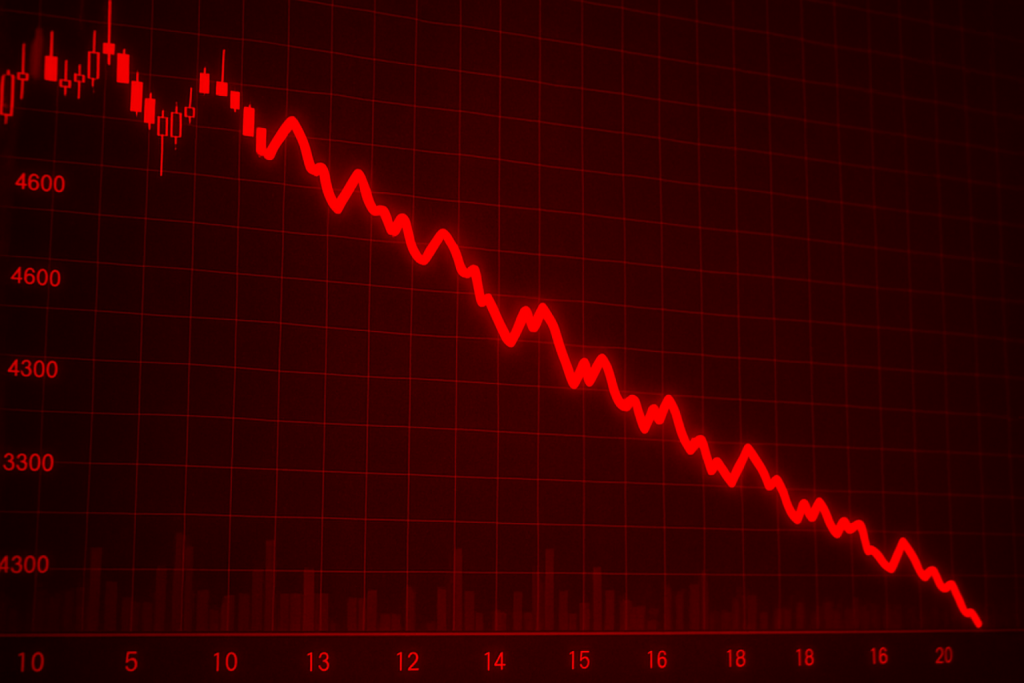

The stock dropped 23.65% to $28.22 on Tuesday open, following the incident involving the company’s Alpha Flight 7 rocket.

Alpha rocket booster destroyed

Firefly confirmed that the first stage of its Alpha Flight 7 rocket exploded during a ground test.

“Proper safety protocols were followed, and all personnel are safe,” the company said in a Monday update.

“The company is assessing the impact to its stage test stand…We learn from each test to improve our designs and build a more reliable system.”

The Alpha booster was destroyed just weeks before its scheduled flight mission, creating another setback for the company’s launch program.

The test failure comes shortly after Firefly closed an investigation into a separate Alpha rocket mission earlier this year.

In April, that rocket placed a Lockheed Martin satellite into a shallow orbit, implying mission failure.

The company has pledged to share more details about the incident and its next steps at a later date.

Market reaction and valuation pressure

Investors responded quickly to the news.

Firefly shares closed Monday at $36.96, giving the company a market capitalization of about $5.4 billion.

The stock has already fallen nearly 18% from its $45 per share IPO price in August, where the offering valued the company at $9.84 billion.

Shares initially surged after the IPO, climbing as high as $73.80 before sliding back in recent weeks.

Analysts remain cautiously optimistic about Firefly’s long-term prospects. Of the seven analysts covering the stock, four rate shares a Buy, with an average price target of $56 per share, according to available data.

The recent setback underscores the risks inherent in the space industry, where development failures are not uncommon and can weigh heavily on young companies with limited flight records.

Difficulties in space industry

The difficulties at Firefly echo broader challenges faced across the space sector.

SpaceX, the dominant player in commercial launch services, has also experienced numerous rocket explosions during testing phases.

Most recently, its massive Starship rocket exploded during a test, damaging ground infrastructure.

Despite such setbacks, SpaceX has achieved significant operational success, with more than 120 Falcon 9 launches completed in 2025 alone.

The company now accounts for more than half of global orbital launches.

Firefly is positioning itself as an end-to-end space solutions provider, spanning launch services, lunar landing, and orbital technologies.

The company notched a significant achievement earlier this year when its Blue Ghost lander successfully reached and operated on the moon in March.

That milestone demonstrated Firefly’s capabilities beyond launch vehicles and highlighted its broader ambitions in space infrastructure.

Still, repeated launch issues present challenges as Firefly works to establish credibility in a competitive and high-stakes market.

For now, the latest rocket test failure has dampened investor sentiment and added pressure to a stock already trading below its IPO price.

The post Firefly Aerospace shares plunge 23% after rocket test explosion appeared first on Invezz